"Retailers are importing more during the holidays this year than last year and that can only mean one thing -- they expect to sell more."

NRF VP Jonathan Gold

WASHINGTON – With the holiday shopping season officially under way, imports at the nation’s major retail container ports are expected to be up 4.4 percent this month over the same time last year and should see a slightly larger increase next month, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

“Retailers are importing more during the holidays this year than last year and that can only mean one thing – they expect to sell more,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Most of the holiday merchandise is already here, but retailers are still restocking to be sure shoppers will have a broad and deep selection as they hit the stores over the next several weeks.”

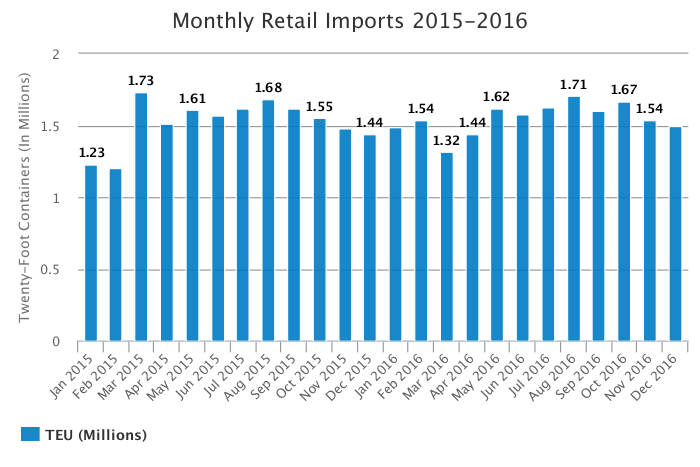

Ports covered by Global Port Tracker handled 1.6 million Twenty-Foot Equivalent Units in September, the latest month for which after-the-fact numbers are available. That was down 6.6 percent from August, the busiest month of the year, and down 1.6 percent from September 2015. One TEU is one 20-foot-long cargo container or its equivalent.

Volume rebounded in October to an estimated 1.67 million TEU, up 7.5 percent from last year. November is forecast at 1.54 million TEU, up 4.4 percent from last year, and December at 1.5 million TEU, up 4.5 percent.

The numbers come as NRF is forecasting $655.8 billion in holiday sales, a 3.6 percent increase over last year. Cargo volume does not correlate directly to sales because only the number of containers is counted, not the value of the cargo inside. But it nonetheless serves as a barometer of retailers’ expectations.

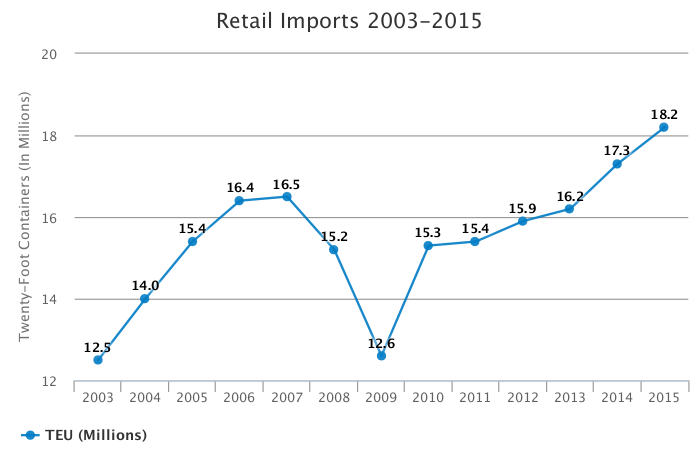

Cargo volume for 2016 is expected to total 18.6 million TEU, up 2.2 percent from last year. Total volume for 2015 was 18.2 million TEU, up 5.4 percent from 2014. The first half of 2016 totaled 9 million TEU, up 1.6 percent from the same period in 2015.

January 2017 is forecast at 1.54 million TEU, up 3.6 percent from January 2016; February at 1.49 million TEU, down 3.2 percent from last year, and March at 1.38 million TEU, up 4.6 percent from last year. Hackett Associates Founder Ben Hackett said U.S. imports are growing, but not as fast as in past years.

“Despite all the good economic news recently, we are faced with imports growing only about 2 percent this year,” Hackett said. “Whether that is merely part of the aftermath of the Hanjin bankruptcy or a sign of weakening demand is not yet clear. Unless there is a major disruption, however, growth should be modest but sustained during the first half of 2017.”

Source: National Retail Federation/Hackett Associates Global Port Tracker Report

National Retail Federation/Hackett Associates Global Port Tracker Report

Global Port Tracker, which is produced for NRF by the consulting firm Hackett Associates, covers the U.S. ports of Los Angeles/Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Hampton Roads, Charleston, Savannah, Port Everglades and Miami on the East Coast, and Houston on the Gulf Coast. The report is free to NRF retail members, and subscription information is available at www.nrf.com/PortTracker or by calling (202) 783-7971. Subscription information for non-members can be found at www.globalporttracker.com.

NRF is the world’s largest retail trade association, representing discount and department stores, home goods and specialty stores, Main Street merchants, grocers, wholesalers, chain restaurants and Internet retailers from the United States and more than 45 countries. Retail is the nation’s largest private sector employer, supporting one in four U.S. jobs – 42 million working Americans. Contributing $2.6 trillion to annual GDP, retail is a daily barometer for the nation’s economy. NRF.com

Hackett Associates provides expert consulting, research and advisory services to the international maritime industry, government agencies and international institutions. www.hackettassociates.com