With the economy improving, consumers are ready to shop and retailers are ready to offer great deals whether they’re buying Easter baskets or garden tools.

Matthew Shay

NRF President and CEO

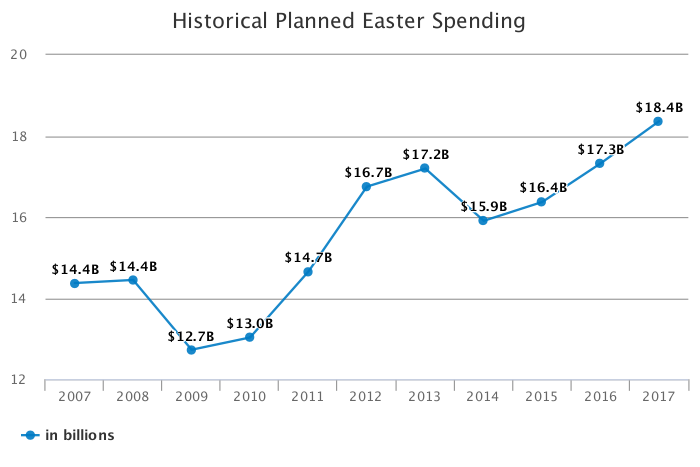

WASHINGTON – Americans will spend more than ever as they celebrate Easter nearly three weeks later this year than last, the National Retail Federation said today. According to NRF’s annual survey conducted by Prosper Insights & Analytics, spending for Easter is expected to reach $18.4 billion, up 6 percent over last year’s record $17.3 billion and a new all-time high in the survey’s 14-year history. Those celebrating plan to spend an average of $152 per person, up 4 percent from last year’s previous record of $146.

“Most consumers have almost an entire extra month to shop for Easter this year, and by the time the holiday comes the weather should be significantly warmer than last Easter,” NRF President and CEO Matthew Shay said. “That should put shoppers in the frame of mind to splurge on spring apparel along with Easter decorations. With the economy improving, consumers are ready to shop and retailers are ready to offer great deals whether they’re buying Easter baskets or garden tools.”

NRF Easter Spending Survey, conducted by Prosper Insights & Analytics

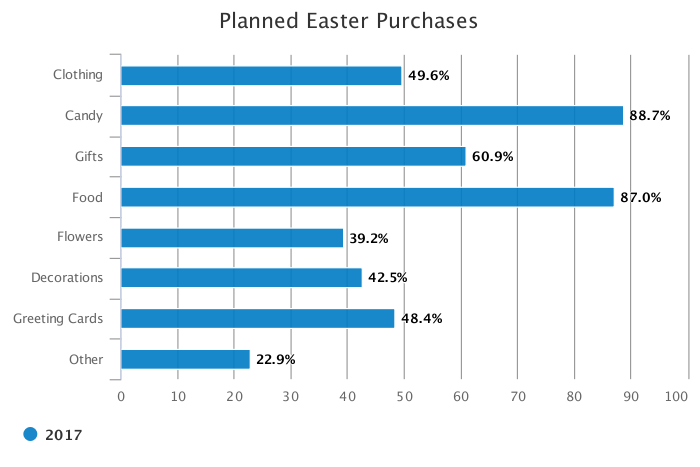

According to the survey, consumers will spend $5.8 billion on food (purchased by 87 percent of shoppers), $3.3 billion on clothing (50 percent), $2.9 billion on gifts (61 percent), $2.6 billion on candy (89 percent), $1.2 billion on flowers (39 percent), $1.1 billion on decorations (43 percent) and $788 million on greeting cards (48 percent).

The 50 percent of consumers planning to buy clothing is up from 45 percent last year and is the highest level in a decade while the $3.3 billion expected to be spent is up 9 percent from last year.

NRF Easter Spending Survey, conducted by Prosper Insights & Analytics

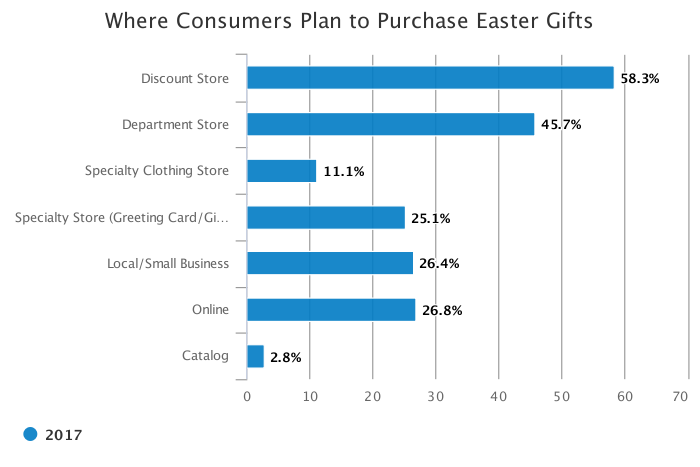

With shopping lists in hand, 58 percent of consumers will head to discount stores, 46 percent will go to department stores and 26 percent will shop at local small businesses. In addition, 27 percent will shop online, up from 21 percent last year. Among smartphone owners, 28 percent will research products on their devices while 18 percent will use their phones to make a purchase, while another 9 percent will use apps to do their research or purchase products.

“Easter continues to be a traditional holiday for consumers of all ages, especially young families who are planning to spend a bit more for this celebration,” Prosper Principal Analyst Pam Goodfellow said. “With the later timing of Easter, we will see more consumers shopping for special deals, especially on apparel and decorations.”

NRF Easter Spending Survey, conducted by Prosper Insights & Analytics

Consumers plan to celebrate Easter in several different ways: 61 percent will visit family and friends, 57 percent will cook a holiday meal, 52 percent will go to church and 17 percent will go to a restaurant. Children will have plenty to look forward to after the Easter Bunny arrives: 35 percent of consumers will have an Easter egg hunt and 16 percent will open gifts. In addition, some consumers will celebrate with more leisurely activities: 43 percent will watch TV, 10 percent will shop online and 9 percent will head to the movies or shop in a store.

The survey, which asked 7,411 consumers about their Easter Sunday plans, was conducted March 1-9 and has a margin of error of plus or minus 1.2 percentage points. Full data results will not be published on NRF.com but news media and analysts who require additional information can contact press@nrf.com.

About Prosper Insights & Analytics

Prosper Insights & Analytics delivers executives timely, consumer-centric insights from multiple sources. As a comprehensive resource of information, Prosper represents the voice of the consumer and provides knowledge to marketers regarding consumer views on the economy, personal finance, retail, lifestyle, media and domestic and world issues. www.ProsperDiscovery.com

About NRF

NRF is the world’s largest retail trade association, representing discount and department stores, home goods and specialty stores, Main Street merchants, grocers, wholesalers, chain restaurants and Internet retailers from the United States and more than 45 countries. Retail is the nation’s largest private sector employer, supporting one in four U.S. jobs — 42 million working Americans. Contributing $2.6 trillion to annual GDP, retail is a daily barometer for the nation’s economy.